If you’ve been paying close attention to viewership data on the four major streaming platforms in gaming, the news last month that Mixer is shutting down probably wasn’t too much of a surprise. But data released by Streamlabs and Stream Hatchet yesterday suggests that the platform’s closure might be coming at an awkward time.

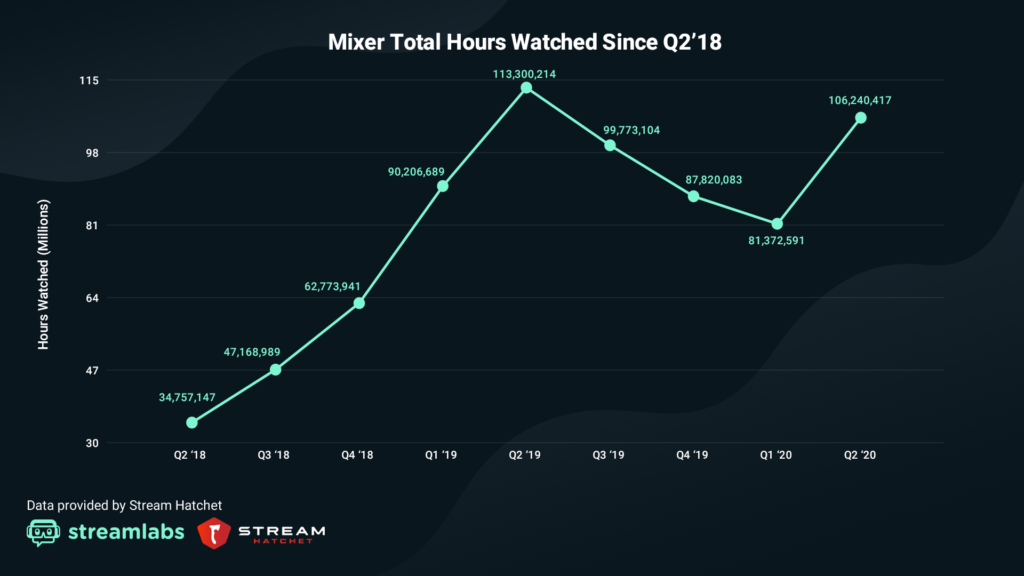

In a Q2 report released yesterday, Streamlabs noted that viewership and activity on Mixer were taking an upward trend relative to the past few quarters.

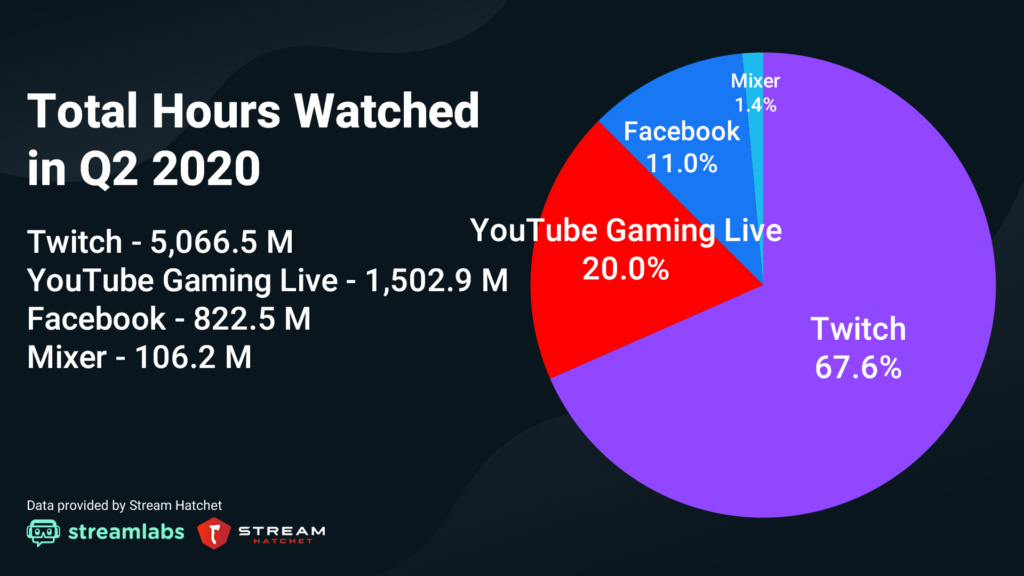

While hours watched and average viewership have steadily increased for YouTube Gaming and Facebook Gaming over the past two years, Twitch has had some of its most significant viewership growth this year.

But prior to this quarter, Mixer was seeing a drop in viewership that started after Q2 of last year. Peaking at 113.3 million hours watched for Q2 2019, the platform slid to 81.4 million hours watched by Q1 2020 before announcing last month that it was ending its services in July.

Now that Mixer is preparing to close up shop and its content creators are finding other platforms to stream on, statistics are showing that the platform had some of its strongest quarter-over-quarter growth ever.

What does that mean for the streaming ecosystem moving forward, though?

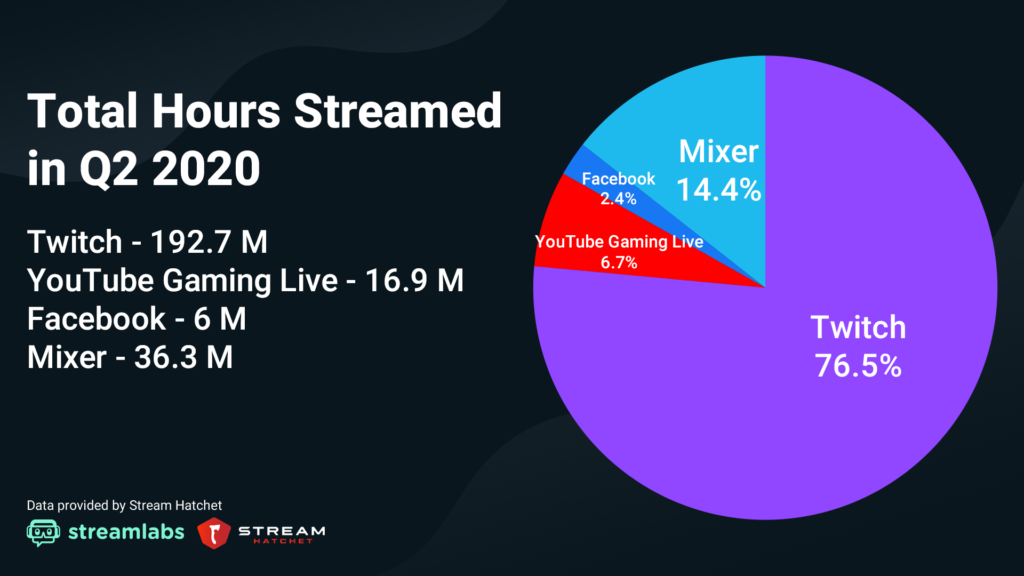

Starting on July 22, Mixer will cease to exist. The five million unique channels that represented 31 percent of the streaming industry will no longer have a place to broadcast unless they go somewhere else.

The Microsoft-owned streaming service is encouraging content creators to move to Facebook Gaming as a part of a partnership that it’s developed with the platform. But they’re free to go wherever they please.

Mixer may have only represented 1.4 percent of the total hours watched among streaming platforms, according to Streamlabs, but its heftier base of unique channels and hours streamed in Q2 suggest that an incoming massive movement could shake things up in the industry.

Even though Mixer won’t be in the picture anymore, Facebook Gaming, which tripled its hours watched year-over-year in Q2, will be.

Not all of Mixer’s streamers will be headed to the platform. But by having Mixer direct people to Facebook, it wouldn’t be surprising to see Facebook’s minuscule 1.2 percent share of unique channels surge in Q3.

At the same time, the prevalence and consistent domination of Twitch has attracted some of Mixer’s personalities—and there’s still no indication where former Twitch stars Ninja and Shroud will end up.

It’s unlikely that Mixer’s end will have an immediate impact that could put Twitch in jeopardy of losing the status it has as the leader in the streaming ecosystem. But by inheriting more users, YouTube and Facebook could stand to gain a more prominent share of the market, fostering a more competitive dynamic between them and Twitch.

Published: Jul 2, 2020 11:00 am